Westside detached house active listings this April are up 6% from March (817 from 772) and are up 38% compared to April 2017. Westside detached home sales this April were up 24% from March (66 to 53) but down 41% compared to 111 sales in April 2017. This year, sales volumes are off 71% from sales in Feb. 2016 (pre foreign buyer tax).

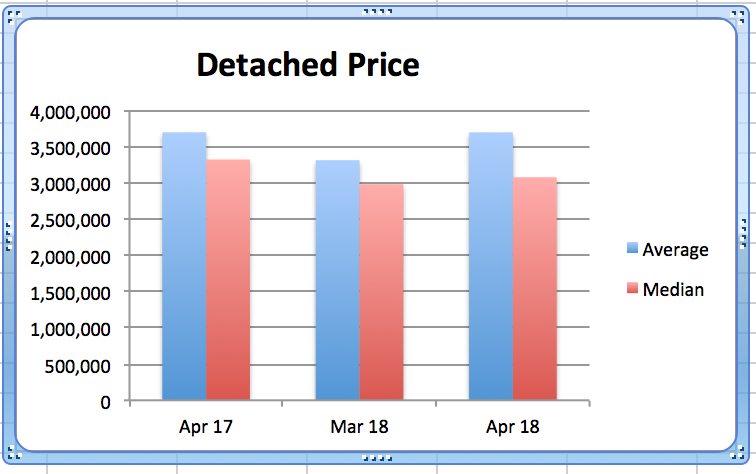

The increase in supply and demand has resulted in a decrease in Months of Supply (MOS) to 12.4, from 14.6 last month but an increase from 5.3 last April 2017. (Usually a balanced market is in the range between 4-5 & 6-7 MOS with prices rising below 4 MOS and falling above 7 MOS). With the the falling MOS this month, detached home prices have increased 11.6% to $3.695M from $3.31M on average and 3% to $3.075M from $2.98M on the median. This is down 18.6% on average & 20% on median from the highs in 2017. If demand stays low, MOS will stay high and that will continue downward pressure on prices. Typically, the 2nd quarter is the busiest time of the year and that is the case this year. I expect to see similar activity in May & June but July and August should be slower.

The highest sale price for a Westside detached home in April was $13.85M. The lowest price was $1.85M. Of those sales, 8 received the asking price or more and 58 sold below the asking price.

Westside apartment supply increased 27% to 908 units in April from 716 in Mar. and this is up 13% from the 631 listings we had April 2017. Demand decreased 5% to 331 sales in April from 349 in March 2018 but this is down 24% from 438 sales April 2017. MOS in Apr is 2.7 vs 2.2 in Mar and that is up from 1.4 last April 2017. These levels are low but they are trending up. The average price increased slightly 5% from $1.035M in Mar. to $1.086M in Apr. and the median increased 5% to $845K from $806K in Mar and increased 11% up from $762K in Apr 2017.

Westside townhouse supply increased 19% this April to 206 homes from 173 in March and up 56% from 132 in Apr. 2017.

Demand in April is up 18% to 46 units from 39 in Mar. but this is down 26% from the 62 sales last April 2017.

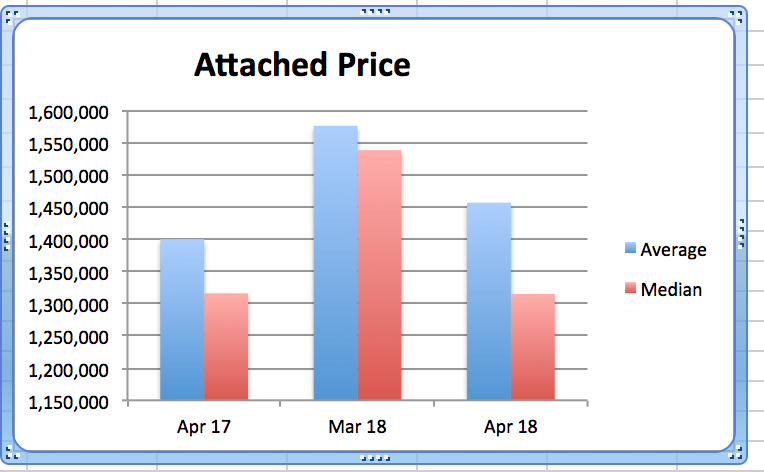

Supply up and demand up equally means the current MOS remained fairly steady at 4.5, up from 4.4 in Mar and up 214% from 2.2 last Apr 2017. Average prices decreased 8% to $1.456M from $1.576M in Mar. and were up 4% from $1.400M last Apr 2017. Median prices decreased

14% to $1.315M in April from $1.538M in Mar and this was the same price as last Apr 2017.

Detached house prices are still low and are delete creating good buying opportunities. Apartment prices are showing the first signs of softening and increasing supply may sustain this trend. Townhouse supply is the highest it has been in two years and softening prices bode well for buyers looking to downsize.

Real estate in Vancouver is facing challenges on many fronts. Two interest rate jumps in the last 8 months totalling 75 basis points have increase mortgage costs by 28%. This coupled with more stringent qualification requirements is causing many mortgages to be turned down and putting the brakes on buying.

Government taxation on foreign buyers, local buyers and current homeowners is also cooling demand as everyone stops to assess the effect on their personal financial situation.

Please consider that Vancouver is not an average city. It is exceptional and one of the top five cities in the world in which to live. Vancouver is surrounded on three sides by water & mountains. Density is our only solution and that makes each home very expensive. Not unlike San Francisco, Hong Kong, Sydney, New York & London, all of which make Vancouver look like a bargain.

It is time for a thoughtful consideration of our problems and some meaningful solutions. What we need to do, is to recognize the cost of; vacant homes in our community, the lack of transparency in home ownership, supporting families not paying income taxes in Canada, the Colossal Failure of Money Laundering Law Enforcement particularly in BC casinos, the lack of family sized apartments in the city, the use of Real Estate by criminals for parking and laundering profit from illegal activities, allowing equity lending to finance real estate purchases and so on and on.

All of these issues need work, study & consultation not the taxation proposed by the NDP. This is a tax grab first & foremost that punishes all homeowners and does not encourage the development of affordable housing our community needs.

The new provincial budget is a direct attack on home owners with policy specifically designed to diminish property values in expensive neighbourhoods. Increased property transfer tax and a school tax surcharge will intimidate buyers, erode property values and do substantial damage to the equity of home owners in this area. These measures will make it particularly difficult for homeowners on fixed incomes to remain in their homes. Assessed values and the equity in our homes is falling while taxes increase.

Please check this link to the BCREA publication on the Economic Fallout of Housing Price Shock (Drops).

This Market Intelligence Report, prepared by the economists at BCREA, forecasts the significant negative consequences for BC homeowners and the BC economy from housing price drops.

We need to have the NDP reconsider their campaign to diminish real estate and repeal these negative tax grabs.

Click on the link at the top right for Westside Graphs.

Please call me at any time for a considered response to any and all of your real estate questions.

Stuart