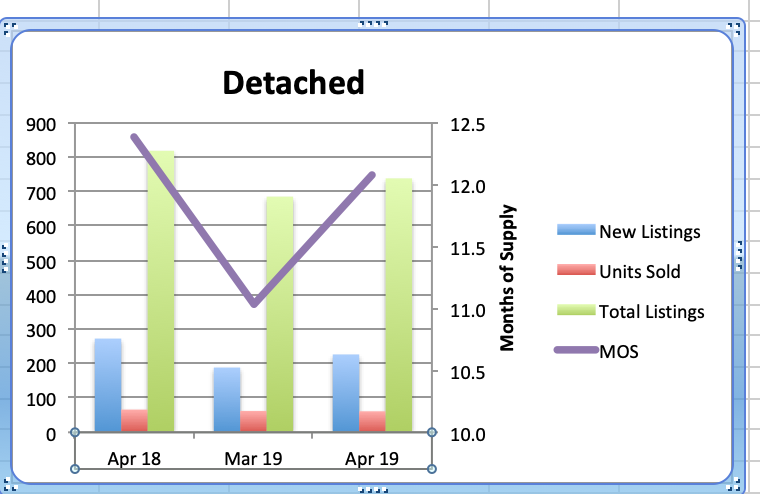

The supply of Westside detached homes in April was 737, up 9.5% from 684 in March and down 2.4% compared to 684 in April 2018.

Westside detached home sales this April remained unchanged from March (61 v 62) and were down 10% compared to 66 sales in April 2018. Sales are down 61% from the 10 year April average of 157 sales.

Months of Supply, (MOS) was up 10% from last month to 12.1 and down 2% from 12.4 in April 2018. (Usually a balanced market is in the range between 4-7 MOS with prices rising below 4 MOS and falling above 7 MOS). This upward trend in MOS has caused the average detached home price to remain unchanged at $3.1M and the median price to increase 7% to $3M. However the price increases are not sustainable. If demand stays low, MOS will stay high and we should see downward pressure on prices. Current prices are still down 27% on average & 27% on median from the peak in 2017.

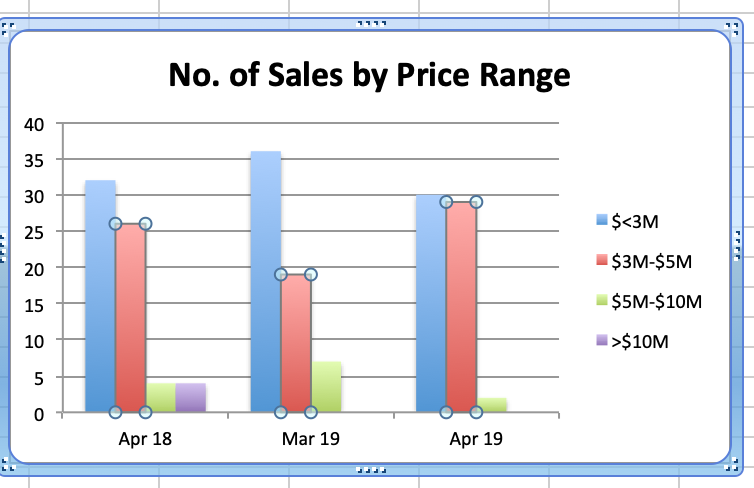

The highest sale price for a Westside detached home in April was $5.6M. It was on the market for 8 days before it sold. The lowest price was $1.5M. It was on the market for 5 days before it sold. Of the 61 April sales, 4 received the asking price or more and 57 sold below the asking price. The implication is that with a sufficiently attractive (low) asking price we can still generate multiple offers.

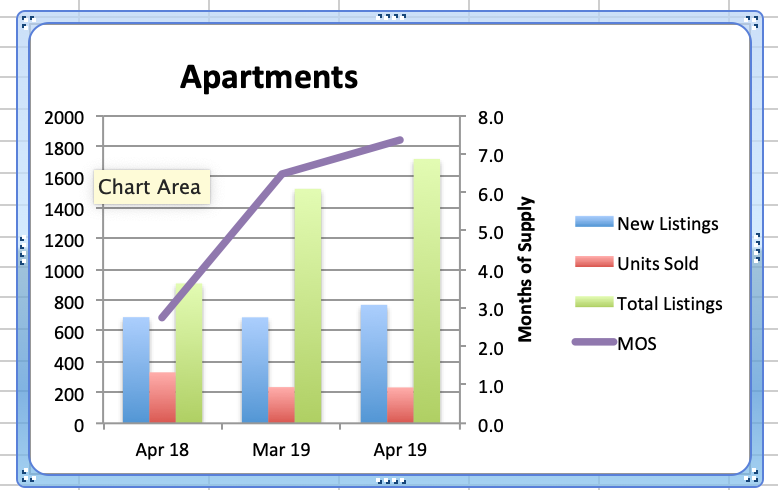

Westside apartment supply increased 13% to 1716 units from 1522 units in March and this is up 168% from the 908 listings we had in April 2018. At the same time, demand remained unchanged (233 sales v. 235 sales in March) and this is down 30% from 331 sales in April 2018.

The result is MOS in April is up 7% to 7.4 from 6.5 in March and up 168% from 2.7 last April 2018.

The average price remained unchanged at $890K v. $887K in March and was down 18% from April 2018. The median price decreased 5% to $733K from $775K in March and is down 13% from last April. Both average and median prices are down by 26% & 17% from the peak of $1.199M and $880K in January 2018.

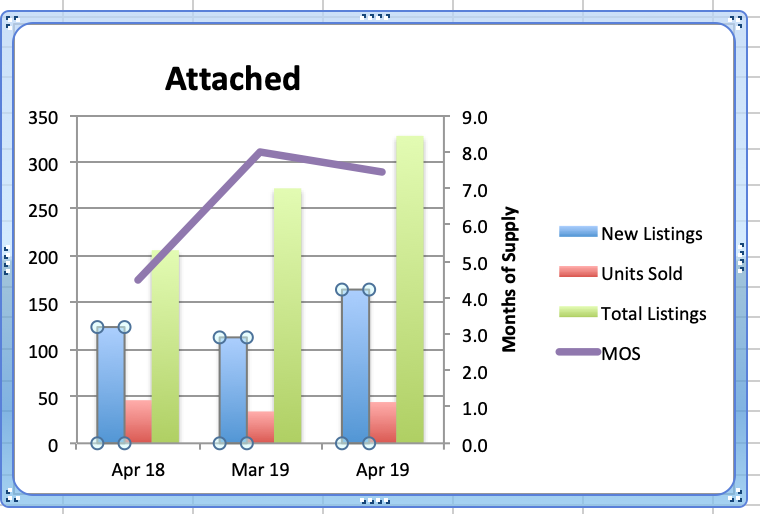

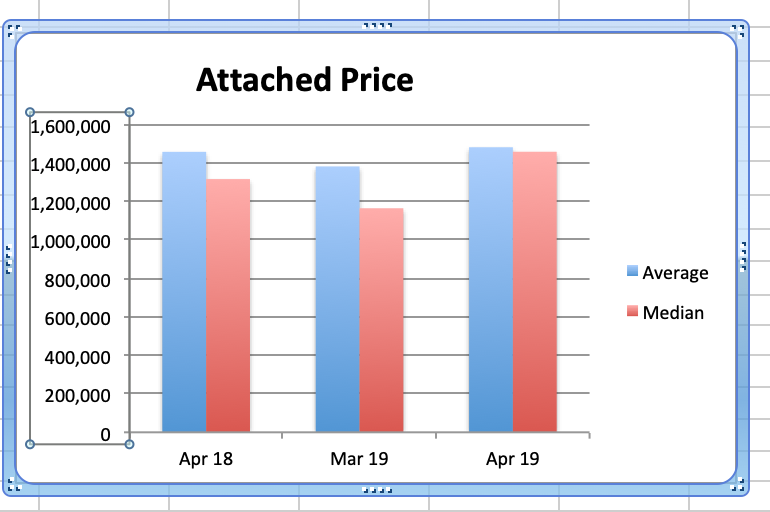

Westside townhouse supply increased 21% this April to 328 homes from 272 in March and that's up 59% from 206 in April 2018. Demand in April is up 30% to 44 sales from 34 in March and down 4% from 46 sales last April 2018.

With both supply and demand up, the current MOS decreased to 7.5 from 8 in March but that is an increase of 66% from 4.5 in April 2018.

Townhouse average prices increased 7.2% ($1.48 v $1.38K) and were up 2% from $1.486M last April 2018. Median prices increased 25% to $1.457M from $1.163M in March and are up 11% from $1.315M in April 2018.

Detached, Attached and Apartments on the west side are for the most part still experiencing price reductions and that is creating good buying opportunities. Many buyers continue holding off in anticipation of further declines in 2019.

The Real Estate Board of Greater Vancouver (REBGV) reports that residential property sales in the region dropped 29.1% to 1829 this April from 2,579 sales in April 2018. March sales were 43.1% below the 10-year April sales Average.

The total number of properties currently offered on the MLS® system in Metro Vancouver is up 46.2% from April 2018 to 14,357. This is up 12.4% from last month.

For all property types, the sales-to-active listings ratio for April 2019 is 12.7%.

Downward pressure on home prices occurs when the ratio dips below the 12% mark for a sustained period, while upward pressure occurs when it surpasses 20% over several months.

Currently, most older homes are selling well below assessed value even with the new lower assessments. Newer or unique homes are selling around assessed value and slightly higher.

The reduced demand we are seeing is due in a large part to political interference from all 3 levels of government and include increased taxes, lending constraints and bureaucratic delays and red tape. These impediments to real estate buyers and sellers are doing nothing to create more affordable housing or to increase the supply of rental housing. The need for shelter does not go away and Vancouver remains a desirable place to live so stifling buyers with these policy changes is merely delaying local demand and disrupting the real estate cycle that was already into a downturn of its own accord.

I agree with Real Estate Board president Ashley Smith who said that Government policy continues to hinder home sales activity. The federal governments mortgage stress test has reduced buyer's purchasing power by about 20%, which is causing entry level buyers to struggle to secure financing. Suppressing home sales through government policy not only reduces the number of sales, it also harms the job market, decreases economic growth and creates pent up demand all of which are negative outcomes and contrary to the stated goal of creating affordable housing.

Please call me at any time for a considered response to any and all of your real estate questions.

Best regards,

Stuart

604 731 0370

StuartBonner@me.com