The supply of Westside detached homes in October was 666, down 1% from 675 in September and down 14% compared to 776 in October 2018.

Westside detached home sales this October increased 32% from September (78 v 59) and were up 24% compared to 63 sales in October 2018. Detached home sales are down 35% from the 10 year October average of 121 sales.

Months of Supply, (MOS) was down 25% from last month to 8.5 and down 31% from 12.3 in October 2018. (Usually a balanced market is in the range between 4-7 MOS with prices rising below 4 MOS and falling above 7 MOS). The Oct average price increased 14% to $3.335M and the median detached home prices increased 23% to $3.044M from September prices. If demand stays high, MOS will stay low and that usually creates upward pressure on prices. Current prices are down 26% on average & 21% on median from the peak in Oct 2017.

The highest sale price for a Westside detached home in October was $15.5M. It was on the market for 1039 days before it sold. The lowest price was $1.6M. It was on the market for 2 days before it sold. Of the 78 October sales, 14 received the asking price or more and 64 sold below the asking price.

Westside apartment supply decreased 10% in October (1317 v. 1463) and this is down 7% from the 1412 listings we had in October 2018. At the same time, demand increased 20% 365 sales v. 303 sales in September) and this is up 36% from 268 sales in October 2018.

MOS in October decreased to 3.6 from 4.8 in September and is down 31% from 5.3 last October 2018.

The average price decreased 4% to $892K in October v. $933K in September and was down 11% from October 2018. The median price decreased to $728K v $789K in September and is down 3% from last October. Average and median prices are down by 26% & 17% from the peak of $1.199M and $880K in January 2018.

Westside townhouse supply decreased 2% this October (281 v. 288) from September and that's up 9% from 258 in October 2018. Demand in October is up 61% to 63 sales from 39 in September and that is also up from 46 sales last October 2018.

With supply down and demand up, current MOS decreased to 4.5 from 7.4 in September. That is down 20% from 5.6 in October 2018.

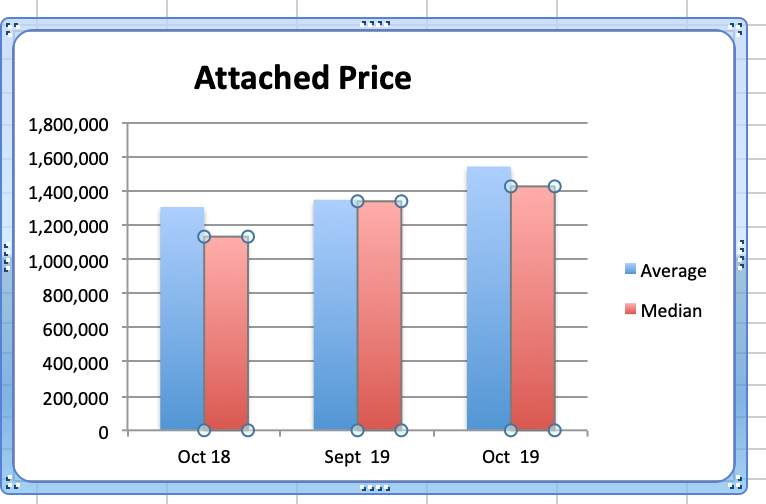

Townhouse average prices were up 14% in October ($1.54M) and were up 18% from $1.3M last October 2018. Median prices increased 6.5% to $1.425M from $1.338M in September and are up 26% $1.13M in October 2018. Both average and median prices are down by 14% & 6% from the peak of $1.8M and $1.5M in January 2018.

Detached, Attached and Apartments on the west side are still priced well below the peak and that is creating good buying opportunities. Detached home prices were creeping up since Feb. this year, dropped for Sept. and have rebounded in Oct but are still 26% below the average peak price in Oct 2017 and appear to be extraordinarily good value.

The Real Estate Board of Greater Vancouver (REBGV) reports that residential property sales in the region increased 45.4% to 2,858 this October from 1966 sales in October 2018. October 2019 sales were 9.8% above the 10-year October sales average.

The total number of properties currently offered on the MLS® system in Metro Vancouver is down 5.8% from October 2018 to 12,236. This is down 9% from last month.

For all property types, the sales-to-active listings ratio for October 2019 is 23.4%.

Downward pressure on home prices occurs when the ratio dips below the 12% mark for a sustained period, while upward pressure occurs when it surpasses 20% over several months.

So while regional numbers are nearing the historical 10 year averages, westside properties are still off the mark making them better relative value. Many sellers are still asking too much to generate offers while serious buyers are finding the sellers who are sharply priced and are buying those homes.

The new assessed values may help sellers see the new pricing reality and encourage buyers to get offers on paper at these discounted prices.

Government policy continues to hinder home sales activity and the only beneficiaries of this policy are people who do not own real estate. If you own real estate consider what government policy has done to your net worth over the last two years. If you don't have fiscal responsibility you will not be able to take care of yourself let alone the rest of the population. Our governments are financially illiterate, spending far beyond our means. They need to develop some backbone and stop pandering to every special interest group with their hands out.

Please call me at any time for a considered response to any and all of your real estate questions.

Best regards,

Stuart