The supply of Westside detached homes in November was 637, down 4% from 666 in October and down 14% compared to 740 in November 2018.

Westside detached home sales this November decreased 15% from October (66 v 78) and were up 10% compared to 60 sales in November 2018. Detached home sales are down 37% from the 10 year November average of 106 sales.

Months of Supply, (MOS) was up 13% from last month to 9.7 and down 22% from 12.3 in November 2018. (Usually a balanced market is in the range between 4-7 MOS with prices rising below 4 MOS and falling above 7 MOS). The Nov average price decreased 12% to $2.925M and the median detached home prices decreased 1% to $3.015M from October prices. If demand stays high, MOS will stay low and that usually creates upward pressure on prices. Current prices are down 36% on average & 22% on median from the peaks in Oct 2017 and Jul 2017.

The highest sale price for a Westside detached home in November was $5.68M. It was on the market for 291 days before it sold. The lowest price was $1.445M. It was on the market for 73 days before it sold. Of the 66 November sales, 13 received the asking price or more and 53 sold below the asking price.

Westside apartment supply decreased 12% in November (1158 v. 1317) and this is down 15% from the 1359 listings we had in November 2018. At the same time, demand decreased 16% 305 sales v. 365 sales in October and this is up 47% from 207 sales in November 2018.

MOS in November increased to 3.8 from 3.6 in October and is down 42% from 6.6 last November 2018.

The average price increased 6% to $948K in November v. $892K in October but was down 7% from November 2018. The median price increased to $775K v $728K in October and is down 7% from last November. Average and median prices are down by 21% & 12% from the peak of $1.199M and $880K in January 2018.

Westside townhouse supply decreased 7% this November (260 v. 281) from October and that's up 8% from 240 in November 2018. Demand in November is down 46% to 34 sales from 63 in October and that is up from 29 sales last November 2018.

With supply down and demand down, current MOS increased to 7.6 from 4.5 in October. That is down 8% from 8.3 in November 2018.

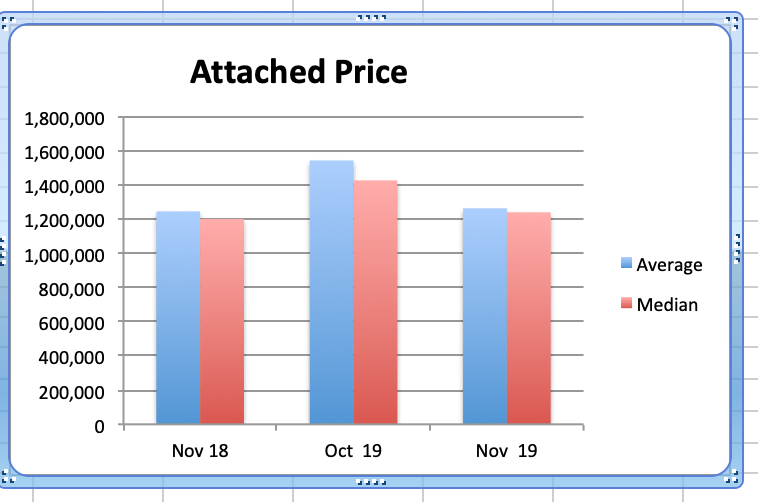

Townhouse average prices in November were down 18% to $1.26M from $1.542M in Oct. and were up 2% from $1.24M last November 2018. Median prices decreased 13% to $1.238M from $1.425M in October and are up 3% from $1.2M in November 2018. Both average and median prices are down by 30% & 18% from the peak of $1.8M and $1.5M in January 2018.

Detached, Attached and Apartments on the west side are still priced well below the peak and that is creating good buying opportunities. Detached home prices were creeping up since Feb. this year, dropped in Sept. and have been up & down since but are still 36% below the average peak price in Oct 2017 and appear to be extraordinarily good value.

The Real Estate Board of Greater Vancouver (REBGV) reports that residential property sales in the region increased 55.3% to 2498 this November from 1608 sales in November 2018. October 2019 sales were 4% above the 10-year November sales average.

The total number of properties currently offered on the MLS® system in Metro Vancouver is down 12.5% from November 2018 to 10,770. This is down 12% from last month.

For all property types, the sales-to-active listings ratio for November 2019 is 23.2%.

Downward pressure on home prices occurs when the ratio dips below the 12% mark for a sustained period, while upward pressure occurs when it surpasses 20% over several months.

So while regional numbers are nearing the historical 10 year averages, westside properties are still off the mark making them better relative value. Many sellers are still asking too much to generate offers while serious buyers are finding the sellers who are sharply priced and are buying those homes.

The new assessed values will accentuate the new pricing reality and encourage sellers to price sharply in order to be the one that sells.

Government policy continues to hinder home sales activity and erode homeowner equity. The many special interest groups and politicians with pet projects continue to expand government budgets at the expense of business and home owners.

Please call me at any time for a considered response to any and all of your real estate questions.

Happy Holidays and all the best for 2020!

Best regards,

Stuart